Auto loan rates play a crucial role in how much you pay for a new vehicle. Understanding these rates is essential for making informed financial decisions.

In today’s market, rates can vary widely based on your credit score, the lender, and the loan terms. This blog will break down what auto loan rates are, what influences them, and how you can find the best offers available.

Let’s dive into the details!

What Are Auto Loan Rates?

Auto loan rates, or the interest rates associated with vehicle financing, represent the percentage of your loan balance that the lender charges as a fee for borrowing money. These rates determine how much interest you will pay over the life of your loan, and they can significantly affect the overall cost of your vehicle purchase.

ADVERTISEMENT

For example, if you’re borrowing $20,000 to finance a car and your auto loan rate is 5%, you’ll end up paying more than $21,000 by the end of the loan term, depending on its length. The higher the rate, the more interest you’ll pay. That’s why securing a low rate is so important—it can save you thousands of dollars over time.

Understanding how auto loan rates work is crucial to making smart financial choices. By taking the time to research and understand the factors influencing these rates, you can reduce your total costs and make more informed decisions.

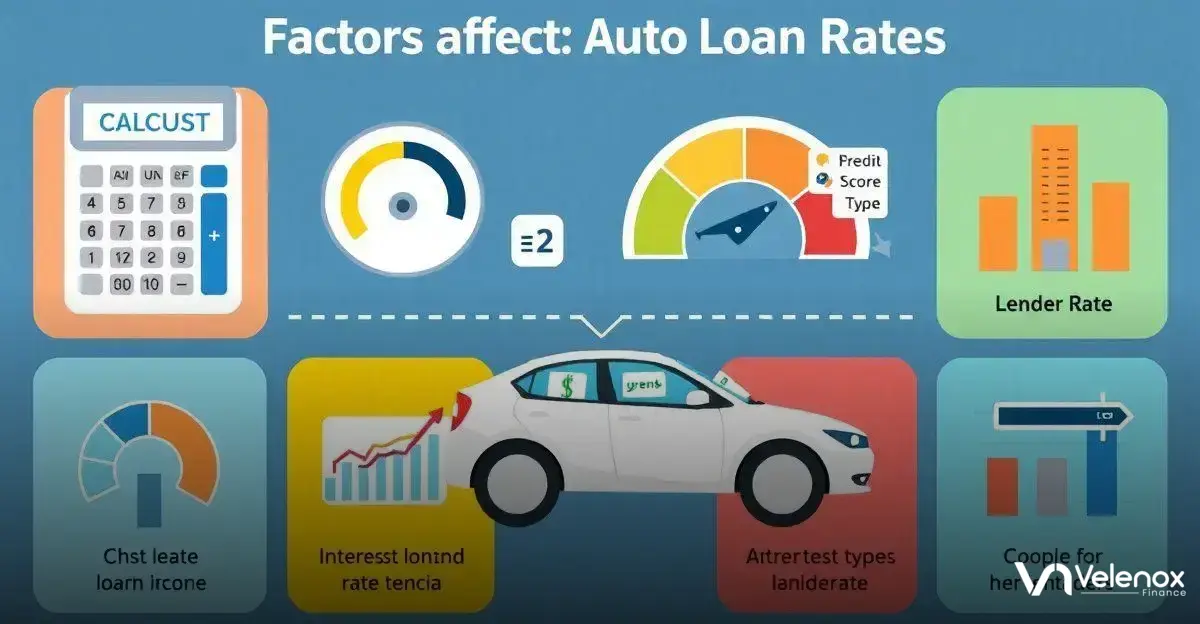

Factors Affecting Auto Loan Rates

Several factors can significantly influence auto loan rates. Understanding these elements can help you prepare for the loan application process and negotiate a better rate. Below are some of the most important factors to consider:

- Credit Score

Your credit score is one of the most critical factors in determining your auto loan rate. Lenders use it to assess your risk as a borrower. A higher score suggests that you are more likely to repay your loan on time, which typically results in lower interest rates. Conversely, a lower credit score may indicate higher risk to the lender, which could lead to higher rates. Improving your credit score before applying for a loan can dramatically lower your interest rate and reduce your overall loan cost; - Down Payment

The amount of your down payment is crucial in influencing your auto loan rate. A bigger down payment decreases the total amount you need to finance, making you a less risky borrower in the eyes of the lender. This can lead to a lower interest rate. Additionally, a larger down payment might enable you to opt for a shorter loan term, which typically offers better rates; - Vehicle Type

The type of vehicle you’re financing can impact your loan rate as well. New cars often come with lower rates than used vehicles due to their higher value and reliability. However, buying a new car can be more expensive upfront, so it’s important to weigh the pros and cons; - Loan Term

Loan terms can also affect the interest rate you’re offered. Generally, shorter loan terms come with lower interest rates, as lenders face less risk of default. However, shorter terms also mean higher monthly payments. Longer terms might reduce your monthly payments, but they typically result in higher overall interest payments, making the loan more expensive in the long run; - Lender Type

Different lenders offer different rates based on their business models and risk assessments. For example, credit unions often provide lower rates compared to traditional banks. It’s crucial to shop around and compare offers from various types of lenders, including online financial institutions, to find the best deal.

By understanding these factors, you can better prepare for your loan application and potentially secure a more favorable rate.

How to Compare Auto Loan Rates

When it comes to comparing auto loan rates, doing thorough research is key. Here are several steps you can follow to ensure you find the best rate for your situation:

- Shop Around

Don’t settle for the first offer you receive. Instead, compare rates from multiple lenders, including banks, credit unions, and online lenders. Online tools and comparison sites can help you see average rates quickly and easily. Keep in mind that the rate you’re offered will depend on your unique financial situation, so the rates you see advertised may differ from the rates you qualify for; - Consider Your Credit Score

Before applying for an auto loan, it’s a good idea to check your credit score. If your score is lower than you’d like, take steps to improve it before applying for a loan. You may find that even a slight improvement in your credit score can lead to a significantly lower interest rate; - Examine Loan Terms

The terms of your loan significantly affect its total cost. Generally, shorter loan terms are associated with lower interest rates, but they lead to higher monthly payments. In contrast, longer terms may provide more manageable monthly payments, but you will pay more in interest throughout the duration of the loan; - Look for Hidden Fees

Some lenders may advertise low rates, but those rates might come with hidden fees or unfavorable loan conditions. Make sure to read the fine print of any loan offer you’re considering and ask about any fees that could increase your overall borrowing costs; - Negotiate

After receiving multiple loan offers, don’t hesitate to negotiate with lenders. If another company has offered you a better rate, use that to see if your preferred lender is willing to match or improve upon it.

By taking these steps, you’ll be better equipped to choose an auto loan rate that fits your budget and financial goals.

Tips for Securing the Best Auto Loan Rate

Now that you know the factors affecting auto loan rates and how to compare them, let’s look at a few tips for securing the best possible rate:

- Check Your Credit Report

Your credit score plays a key role in determining your loan rate. Before applying for an auto loan, review your credit report to make sure there are no inaccuracies that could lower your score. Fixing any errors can raise your score and increase your chances of getting a better rate; - Make a Larger Down Payment

As mentioned earlier, a larger down payment can reduce your loan amount and make you a less risky borrower. This can result in a lower interest rate, saving you money over the life of the loan; - Choose a Shorter Loan Term

Shorter loan terms usually come with lower rates, so if you can afford higher monthly payments, it’s worth considering a shorter term. Just make sure the monthly payments fit within your budget; - Consider Different Lenders

Don’t limit yourself to traditional banks. Credit unions and online lenders often offer more competitive rates, so it’s worth exploring all your options. Be sure to compare rates and terms from several lenders before making a decision; - Prequalify

Some lenders offer prequalification, which allows you to see the rates you may qualify for without a hard inquiry on your credit report. This can help you shop for the best rate without negatively impacting your credit score.

By following these tips, you can increase your chances of securing a favorable auto loan rate and reducing your overall loan costs.

Common Mistakes to Avoid with Auto Loans

When applying for an auto loan, it’s important to avoid common mistakes that can cost you money. Here are a few to watch out for:

- Not Checking Your Credit Score

If you don’t check your credit score before applying for a loan, you might end up with a higher interest rate than necessary. Knowing your score allows you to take steps to improve it before applying for a loan; - Failing to Compare Offers

Many people make the mistake of accepting the first loan offer they receive. Comparing rates from multiple lenders can save you thousands of dollars over the life of your loan; - Ignoring the Fine Print

Be sure to read the terms and conditions of any loan offer carefully. Hidden fees or unfavorable conditions can increase your borrowing costs significantly.

In Conclusion

Understanding auto loan rates and how to secure the best deal is vital for any car buyer. By avoiding common mistakes, comparing offers, and being aware of influencing factors, you can navigate the process with confidence.

Always keep your credit score in check and consider making a larger down payment to lower your loan amount. Remember that shopping around for rates can make a significant difference in your overall costs.

With the right knowledge, you can make smarter financial decisions and drive away with a vehicle that fits both your needs and your budget.