Luxury investment strategies focus on acquiring high-value assets such as art, rare collectibles, and real estate to build wealth and diversify your portfolio.

To start your luxury investment journey, define your goals, educate yourself, set a budget, and seek expert advice while avoiding common mistakes like overpaying or neglecting market trends.

In today’s financial landscape, luxury investment strategies are gaining significant attention from affluent investors.

By focusing on high-value assets, investors can diversify their portfolios and enhance long-term wealth.

ADVERTISEMENT

Understanding Luxury Investment Strategies

Understanding luxury investment strategies is essential for investors looking to maximize their wealth. These strategies focus on acquiring high-value assets that tend to appreciate over time.

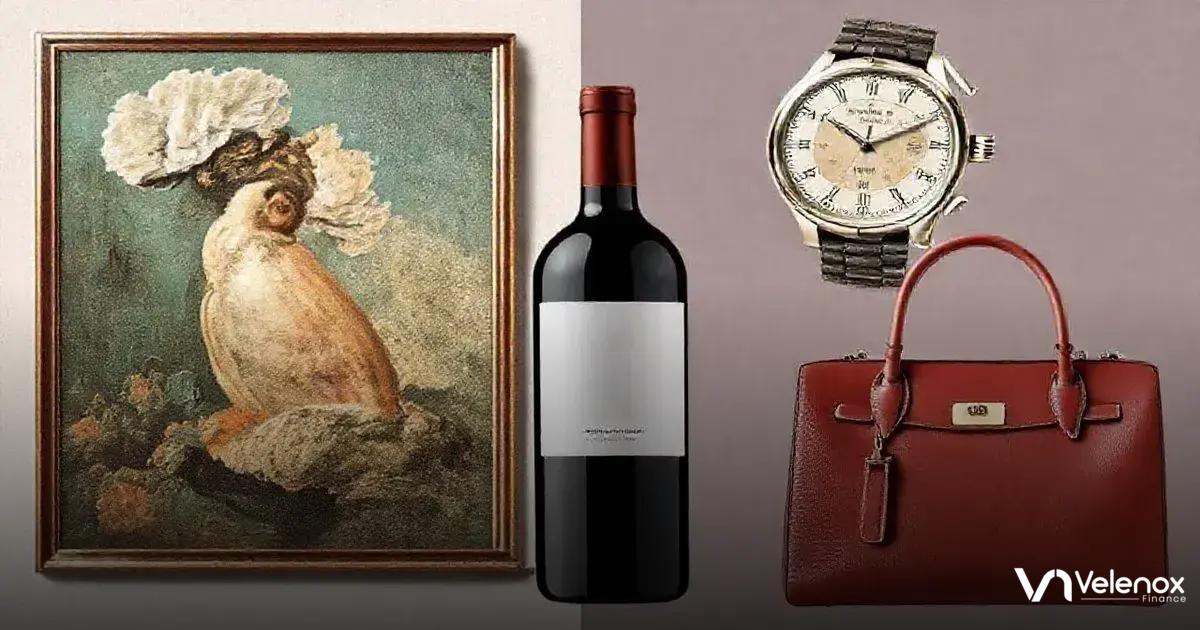

Luxury investments can include items such as fine art, antique furniture, rare collectibles, and high-end real estate.

Defining Luxury Investments

Luxury investments are typically assets that are not only expensive but also offer potential for significant value increases.

Unlike traditional investments, they often have intrinsic value, meaning their worth can appreciate due to rarity and demand.

Types of Luxury Investment Strategies

Common luxury investment strategies include:

- Collectibles: Items like stamps, coins, and vintage wine can yield profound returns.

- Art Investments: Investing in works by renowned artists can provide both aesthetic appreciation and financial rewards.

- Luxury Real Estate: High-end properties not only serve as residences but also as lucrative investment avenues in prime locations.

Why Invest in Luxury?

Investing in luxury assets offers several advantages:

- Diversification: Luxury goods can be a buffer during economic downturns, as they typically retain value.

- Inflation Hedge: Many luxury investments appreciate in value during inflationary periods, protecting your wealth.

- Passion Assets: Investors often engage with assets they’re passionate about, making the investment journey more enjoyable.

In conclusion, grasping the fundamentals of luxury investment strategies can empower investors to make informed decisions that contribute to long-term wealth accumulation.

Top Luxury Assets to Consider

When exploring top luxury assets to consider, it’s essential to know which items can yield the best returns. Here are some key categories to explore:

Fine Art

Investing in fine art has become increasingly popular. Masterpieces from renowned artists can greatly appreciate in value over time.

Artwork not only beautifies a space but also serves as a unique investment.

Rare Wine

Collectible wines, especially famous vintages, can offer excellent investment opportunities.

As wine ages, its value can grow significantly, attracting both connoisseurs and investors alike.

Luxury Watches

High-end watches from brands like Rolex or Patek Philippe are prized by collectors.

These timepieces often appreciate in value, particularly limited editions or historical models.

Classic Cars

Investing in classic cars can be both enjoyable and profitable.

Models that are rare and in good condition can see substantial price increases at auctions.

Jewelry

Fine jewelry pieces, especially those with gemstones, can hold their value or even appreciate.

Investing in branded items creates further demand and potential for higher returns.

High-End Real Estate

Luxury properties in sought-after locations provide a solid investment opportunity.

These properties tend to appreciate faster than regular real estate, making them a savvy choice for seasoned investors.

Designer Handbags

Limited edition or classic designer handbags from brands like Chanel or Hermès can be lucrative investments.

The demand for these items often leads to increased resale values.

By diversifying your investments across these luxury assets, you can create a robust portfolio that positions you for financial growth and success.

Risk Analysis in Luxury Investments

Conducting risk analysis in luxury investments is vital for safeguarding your assets. Here are key factors to consider:

Market Volatility

The market for luxury goods can fluctuate significantly. Understanding how trends and economic changes affect luxury assets is critical.

Monitor current events, browse industry reports, and recognize seasonal trends.

Asset Authenticity

Luxury items are frequently subject to counterfeiting. Ensuring the authenticity of assets is crucial.

Always obtain certificates of authenticity or verification from reputable sources when purchasing.

Liquidity Risk

Some luxury assets can take time to sell, leading to liquidity risk. Evaluate how quickly you can access cash from your investments.

Items such as fine art may not sell quickly, while others like luxury watches might have a more active market.

Insurance Protection

Having insurance helps protect your luxury investments from theft, damage, or loss. Consult with providers specializing in high-value insurance to cover risks effectively.

Condition of Assets

The condition of luxury goods significantly impacts their value. Ensure proper care and maintenance to preserve their integrity and worth.

Regular evaluations can help determine if any restoration or maintenance is needed.

Regulatory Risks

Changes in regulations, especially in high-value markets, can affect your investments.

Stay informed about local laws regarding ownership, tax implications, and potential tariffs on luxury items.

Emotional Bias

Investors often become attached to personal collections. Emotional bias can cloud judgment and lead to poor investment decisions.

Always base decisions on market data rather than sentiment.

By addressing these risk factors and maintaining a cautious approach, investors can better navigate the complexities of luxury investments and enhance their financial safety.

Long-term Benefits of Luxury Investments

Investing in luxury assets comes with numerous long-term benefits that can enhance your financial portfolio. Here are some key advantages:

Value Appreciation

Many luxury assets, like fine art and rare collectibles, appreciate over time.

Their value can increase significantly, offering substantial returns on investment when sold in the future.

Diversification of Portfolio

Incorporating luxury items into your investment portfolio diversifies your holdings.

This reduces risk by spreading investments across different asset classes, helping to stabilize your overall financial strategy.

Inflation Hedge

Luxury assets often function as a hedge against inflation.

During inflationary periods, prices of luxury items can rise, protecting your investment’s value.

Emotional and Aesthetic Value

Luxury investments are not just financial assets; they also provide emotional rewards.

Owning items of beauty, like fine jewelry or classic cars, can enhance your quality of life and bring personal satisfaction.

Potential for Passive Income

Some luxury assets can generate passive income.

For example, luxury real estate can be rented out, providing a steady stream of cash flow while the property’s value appreciates.

Networking Opportunities

Investing in luxury items can open doors to exclusive communities and networking opportunities.

Engaging with other investors and collectors can lead to future investment opportunities and partnerships.

Legacy Building

Luxury investments can serve as a legacy for future generations.

High-value assets can be passed down, providing financial security for your heirs.

By recognizing these long-term benefits, investors can make informed decisions that align with their financial goals and secure their futures with luxury investments.

Evaluating Market Trends

When it comes to evaluating market trends in luxury investments, staying informed is key. Here are important areas to focus on:

Understanding Demand

Identify what luxury items are currently in demand.

Look for shifts in consumer preferences and track auctions or sales data to reveal popular assets.

Economic Indicators

The economic climate greatly influences luxury investments. Watch for changes in interest rates, inflation, and consumer spending patterns, as these factors can affect demand and prices.

Stay Updated with Industry Reports

Reading industry reports and market analysis can provide valuable insights.

Sources like art market reports, luxury goods sales data, and expert opinions are useful for understanding trends.

Social Media and Influencer Insights

Social media platforms often spotlight trends in luxury items.

Follow influencers and luxury brands to observe what products are gaining popularity and why.

Historical Trends

Analyzing historical data can provide context for current market conditions.

Look at past performance of similar luxury items to anticipate potential future trends.

Geographic Considerations

Market demand for luxury goods can vary by location.

Understanding regional preferences and economic health can help identify emerging markets or potential risks.

Limited Editions and Collaborations

New product releases, especially limited editions and celebrity collaborations, can create buzz and drive demand.

Keeping an eye on upcoming launches is important for investment opportunities.

By analyzing these aspects of the market, investors can make informed decisions about which luxury assets to acquire and when to sell, ultimately enhancing their investment strategies.

Creating a Diversified Luxury Portfolio

Creating a diversified luxury portfolio involves carefully balancing different types of luxury assets. Here are steps and strategies to achieve this:

Mix Asset Types

Include a variety of luxury items such as fine art, rare wines, classic cars, and designer handbags.

Each asset type behaves differently in the market, helping to spread risk.

Evaluate Risk Levels

Assess the risk associated with each asset class. Fine art might have different risks compared to luxury real estate.

Understanding these risks can help maintain balance in your portfolio.

Investment Amounts

Decide how much money to invest in each asset type.

A well-planned budget allows you to allocate funds wisely, ensuring no single investment dominates your portfolio.

Market Research

Regularly conduct market research to stay informed about trends that can affect luxury investments.

Understanding industry news will help you make timely decisions about buying and selling assets.

Long-term vs Short-term Investments

Decide which assets you want to hold for the long term and which may be more suitable for short-term gains.

Balancing these strategies can bolster your financial growth.

Monitor Performance

Regularly analyze how each asset in your portfolio is performing.

This helps in making necessary adjustments if certain assets underperform, keeping your portfolio robust.

Consult Experts

Consider working with luxury investment advisors. Their expertise can provide valuable insights and help you refine your investment strategy.

By following these steps, you can create a diversified luxury portfolio that positions you for growth and stability in the luxury investment market.

Common Mistakes in Luxury Investing

Understanding the common mistakes in luxury investing can save you from costly errors. Here are several pitfalls to avoid:

Not Doing Enough Research

Many investors rush into luxury investments without proper research.

Always take the time to learn about the asset, market trends, and historical performance.

Overpaying for Assets

Buying luxury items at inflated prices can lead to disappointment.

Get appraisals and compare prices to ensure you’re paying a fair value.

Ignoring Authenticity Checks

Counterfeit luxury items can drain your investment.

Always verify the authenticity of an asset, especially for high-value purchases like art and jewelry.

Pursuing Trends Instead of Value

Investing based on fleeting trends can result in losses.

Focus on items that have solid historical value instead of those popular in the moment.

Neglecting Proper Care and Maintenance

Luxury items often require upkeep. Failing to maintain items like fine watches, art, or classic cars can decrease their value over time.

Not Diversifying Your Portfolio

Putting all your money into one type of luxury asset can be risky. Diversification helps manage risk and is crucial for a balanced investment strategy.

Choosing Too Many Emotionally Driven Investments

While it’s tempting to invest in items you love, emotional attachments can cloud judgment. Base decisions on data and market research instead.

Failing to Monitor Market Changes

The luxury market can be volatile. Regularly monitoring your investments and market changes helps you make informed decisions about buying or selling.

By avoiding these common mistakes, you can navigate the luxury investment landscape more effectively and boost your chances for success.

How to Start Your Luxury Investment Journey

Starting your luxury investment journey can be rewarding and exciting. Here are some steps to guide you:

1. Define Your Goals

Determine what you want to achieve with your investments.

Are you focusing on wealth growth, personal enjoyment, or legacy building? Clear goals will shape your strategy.

2. Educate Yourself

Learn about various luxury assets, such as art, real estate, and collectibles.

Reading books, articles, and attending seminars can enhance your knowledge and confidence.

3. Set a Budget

Decide how much money you can allocate to luxury investments.

A well-planned budget helps avoid overextending yourself and encourages smarter spending.

4. Start Small

Begin with small investments to gain experience.

This approach allows you to understand the market dynamics without taking on significant risks.

5. Build a Network

Connect with other investors and industry professionals.

Networking can provide valuable insights, tips, and potential investment opportunities.

6. Research the Market

Stay informed about market trends, price changes, and emerging assets. Regular research will help you make educated decisions and identify lucrative opportunities.

7. Consult with Experts

Consider seeking advice from luxury investment advisors. Their expertise can help you navigate the landscape and maximize your investments.

8. Review and Adjust

Regularly assess your investments and strategy. If certain assets underperform or market dynamics shift, be prepared to make adjustments.

By following these steps, you can effectively embark on your luxury investment journey and work toward achieving your financial goals.

FAQ – Frequently Asked Questions about Luxury Investment Strategies

What are luxury investment strategies?

Luxury investment strategies involve acquiring high-value assets, such as art, real estate, and collectibles, to build wealth and create a diverse portfolio.

How do I start my luxury investment journey?

Begin by defining your goals, educating yourself about luxury assets, setting a budget, starting small, and networking with other investors.

What are common mistakes in luxury investing?

Common mistakes include not doing enough research, overpaying for assets, ignoring authenticity checks, and neglecting portfolio diversification.

Why is market trend evaluation important?

Evaluating market trends helps investors make informed decisions, anticipate changes in demand, and identify potential investment opportunities.

What are the long-term benefits of luxury investments?

Long-term benefits include value appreciation, portfolio diversification, inflation protection, emotional satisfaction, and the potential for passive income.

How can I create a diversified luxury portfolio?

Mix different types of luxury assets, evaluate risk levels, monitor performance, and make adjustments as needed to maintain a balanced portfolio.