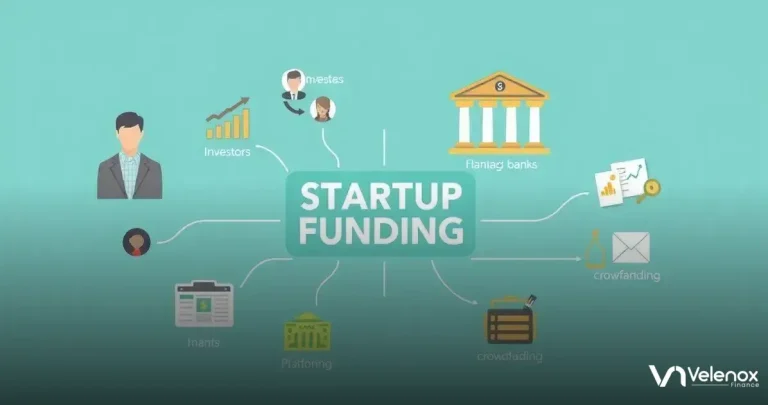

Understanding startup funding options is key to making your business thrive.

They offer various ways to gather the money needed to launch your idea or grow your existing business.

Each funding option has its unique features, benefits, and challenges.

Knowing these can help you make informed decisions that align with your business goals.

ADVERTISEMENT

Common funding options include personal savings, bank loans, angel investors, and crowdfunding.

Personal savings allow you to keep full control over your business but come with financial risk.

On the other hand, bank loans require you to repay with interest.

Angel investors, however, provide capital in exchange for ownership stakes, offering both funds and mentorship.

Crowdfunding has gained popularity in recent years, allowing you to raise small amounts of money from many people via online platforms.

This method not only helps finance your project but also creates early supporters who are invested in your success.

The right choice will depend on your startup’s specific needs, market, and the level of control you want to retain.

Startup funding options are crucial for entrepreneurs aiming to bring their ideas to life.

Navigating through various funding sources can be overwhelming, yet it is vital for starting or scaling your business.

Whether you’re considering bootstrapping, seeking angel investments, or exploring venture capital, understanding these options can significantly influence your growth.

Understanding Startup Funding

Understanding startup funding is essential for anyone looking to start a new business.

Funding can help turn ideas into reality and provide necessary resources for growth.

When you understand how startup funding works, you can make informed decisions and set your business on the right path.

There are several types of startup funding available, including personal savings, loans, and investments from friends or family.

Each option has its benefits and drawbacks. Knowing these can help you choose the best way to get the money you need.

Moreover, understanding the stages of funding is also crucial.

Early stages might involve small amounts of money, while more advanced stages could include larger investments from venture capitalists.

As you learn about these funding options, you’ll be better prepared to approach investors and secure financial support for your venture.

Types of Startup Funding Options

Types of startup funding options can vary widely, each offering unique benefits.

One common option is bootstrapping, where founders use their own savings to fund their business.

This method can give entrepreneurs full control over their startup, although it may limit available resources at the start.

Another popular choice is seeking investments from friends and family.

This approach can help new entrepreneurs raise initial capital without the pressure of formal investors.

However, it’s important to treat these arrangements seriously, as it may affect personal relationships if the business does not succeed.

Venture capital is another significant funding option for startups aiming for rapid growth.

In this case, investors provide large sums of money in exchange for equity in the company.

While this can fuel fast expansion, it may also mean giving up a portion of your control over the business.

Understanding all these types of startup funding options is key to making the right choice for your venture.

How to Choose the Right Funding Option

Choosing the right funding option is a critical step for any startup. Start by assessing your business needs and determining how much capital you require.

Understanding your goals will help you identify which funding source fits best.

For instance, if you plan to grow slowly, bootstrapping might be suitable, while rapid growth may call for venture capital.

Next, consider the pros and cons of each funding option. Personal savings keep you in control, but they might limit your resources.

In contrast, loans can provide necessary funds, but they come with interest payments.

Make a list of what matters most to you, like control, speed of growth, and repayment terms.

Finally, think about your ability to present your business idea to potential investors. Prepare a solid pitch that highlights your vision and business plan.

If you feel confident sharing your idea, seeking angel investors or venture capital might be a great option.

Taking these steps will guide you in making the right choice for your funding needs.

Best Practices for Securing Funding

Best practices for securing funding start with having a clear business plan. A strong plan outlines your goals, target market, and financial projections.

This document acts as your roadmap, helping investors understand your vision. Make sure it is detailed, realistic, and shows how their money will be used effectively.

Next, focus on building relationships with potential investors. Networking can pave the way to valuable connections.

Attend industry events, join startup groups, or use social media to find stakeholders interested in your field.

Engaging with the community helps you get noticed and shows that you are serious about your venture.

Lastly, practice your pitch to ensure you present your ideas confidently. Investors want to see passion and clarity.

Prepare for questions they might ask and have solid answers ready.

A well-prepared pitch demonstrates your commitment and can significantly improve your chances of securing the funding you need.

Common Challenges in Startup Funding

Common challenges in startup funding can often create roadblocks for new entrepreneurs. One major difficulty is the lack of clearly defined goals.

Investors want to see a well-structured plan that outlines your business strategy and growth potential.

Without clear objectives, it can be hard to convince them to provide the necessary funds.

Another challenge is standing out in a crowded market.

Many startups compete for attention and funding, which makes it essential to showcase what makes your business unique.

If you cannot effectively communicate your unique selling points, you may struggle to attract the right investors.

Lastly, financial expectations can create stress during the funding process.

Investors might have high demands for returns, which can be hard for new businesses to meet.

Balancing these expectations with your company’s capabilities is crucial.

By being transparent and realistic about your financial goals, you can build trust and improve your chances of securing funding.

The Role of Investors and Equity

The role of investors and equity is vital in the startup funding process.

Investors provide the necessary capital to help businesses grow in exchange for ownership shares, known as equity.

This means that when investors put money into a startup, they gain a percentage of the business and its potential profits.

Having investors on board can bring more than just financial support; they often offer valuable advice and connections.

Experienced investors can guide entrepreneurs through challenges and help open doors to new opportunities.

Their insights can be especially helpful in making smart business decisions and navigating the market.

However, it’s essential for founders to understand that accepting investment can mean giving up some control.

Investors may want to influence business decisions based on their interests.

Therefore, clear communication about expectations and the role of equity is crucial.

This way, both the entrepreneurs and investors can work together effectively and pursue common goals.

Preparing a Pitch for Funding

Preparing a pitch for funding is an important step for any entrepreneur seeking financial support.

Start by creating a clear and engaging presentation that outlines your business idea.

Make sure to include your goals, target audience, and how you plan to make money.

Visual aids, like charts and graphs, can help make your points more convincing.

Next, practice your delivery. Talk through your pitch several times to build confidence. Be ready to answer questions that investors may have.

They might ask about your business model, the competition, or your team’s experience.

Being prepared for these questions shows that you have thought things through and are serious about your startup.

Lastly, keep your pitch concise. Investors often hear many proposals, so it’s essential to grab their attention quickly.

Aim for a short and focused presentation that highlights the most important aspects of your business.

A strong pitch not only informs but also excites investors about the potential of your startup.

Choosing the right funding options is essential for the success of your startup.

Understanding the various sources of funding can help you make informed decisions.

You might consider personal savings, loans, or investments from friends and family as your first steps.

Each option has its advantages and challenges, so it’s important to evaluate what fits best with your business’s needs and growth plans.

One of the most popular ways to secure funding is through venture capital.

This involves investors who provide significant funds in exchange for equity in your company.

While this can fuel rapid growth, it’s crucial to understand how much control you are willing to give up.

Weigh the benefits of having more capital against the potential loss of influence over your business decisions.

In addition, you might explore crowdfunding as a modern funding method.

Many entrepreneurs use platforms to reach a larger audience and gain small investments from multiple people.

This approach not only raises capital but also builds a community around your product.

However, it’s important to create a compelling campaign that clearly explains your goals and engages potential backers.